Opinion: Why a Blended onshore/offshore finance team works so well

Introduction:

In the dynamic landscape of finance and accounting, CFOs and Finance Directors are constantly seeking innovative strategies to enhance efficiency, reduce costs, improve cash flow, and drive performance in their finance teams – particularly around month-end or quarter-end time! One approach gaining momentum is the adoption of a blended onshore and offshore finance team.

I can speak first-hand to the benefits of this approach as, at flexhive, we adopted this model ourselves approximately three years ago with impressive results, which I’ll cover later on.

Firstly though, what do we mean when we talk about a ‘blended’ finance team?

The Blended Finance Team Defined

A blended finance team combines the strengths of both onshore and offshore finance professionals to create a synergistic and high-performing finance team. Typically, the best way to structure the team is to allocate onshore team members to more critical or strategic finance functions, while offshore counterparts manage more routine and repetitive tasks, allowing for a more streamlined and cost-effective finance operation.

Additionally, you can allocate effort and resourcing mix based on the value of the client or vendor to which the effort relates. For example, consider the level of interaction, difficulty, or value to the organisation associated with each. This can be particularly true in the Credit/AR function, where a useful strategy could be to entrust collection responsibilities for lower-value accounts to offshore team members and higher-value/higher-risk accounts to onshore team members.

Finally, location also plays a part. Sometimes, due to local compliance and knowledge, it makes sense for certain functions to be carried out either onshore or offshore.

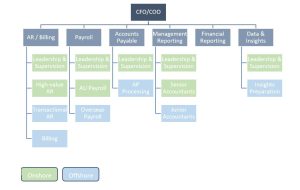

At flexhive by Hudson, we apply a combination of all of the above to our resourcing mix in the finance functions. Below is our organisational chart that highlights both onshore and offshore resources across the finance functions:

What you’ll note from the above are a few key characteristics:

- Leadership & Supervision are always carried out onshore. This promotes consistency and standardisation of processes and ensures that escalation points and ultimate decision-making are closer to home. It can, however, give rise to some challenges around supervising offshore staff in a remote location, though I’ll explain how to tackle those later on.

- Higher-value, higher-risk activities are conducted onshore. This is particularly the case in our Accounts Receivable function, where larger, more complex accounts are managed by more senior staff. In addition, Senior Accountants in the Management Reporting function are all based onshore.

- Location: All of our Financial Reporting is conducted onshore due to the knowledge required of Australian Accounting Standards and local tax and compliance. Similarly, where we conduct payroll outside of Australia, we leverage offshore resources to conduct these activities.

- The more process and procedure led, the higher the level of comfort with conducting the activities offshore. Billing, Accounts Payable processing, and data preparation are all characteristic of being predominantly mechanistic in nature, so we confidently entrust highly-qualified team members offshore to conduct these activities.

Challenges to overcome with the blended finance team:

- Supervision of staff in remote locations – supervising staff located remotely brings some obvious challenges, but the best way to overcome them is equally obvious – set clear expectations for your offshore team members and manage via output. There is no place to hide in finance teams if you’re not pulling your weight – delays and errors occur, and the whole machine can grind to a halt. Set clear expectations and provide clear instructions for your offshore team members, and remote supervision via output becomes very simple.

- Buy-in from onshore leadership – this is where the whole thing can come crumbling down. CFO, FD, and COO can all be on board, but if second-layer management or finance leadership staff aren’t, then the whole thing will come crashing down. It’s incumbent on senior finance staff to embrace their working relationships with offshore team members, work with them in the same way they would with anyone sitting next to them locally, and set and achieve goals together.

- Data security – with sensitive financial data and spreadsheets changing hands across borders, how do you get assurance that data is not leaked or compromised? We partner with an organisation called Island Browser who brings an enterprise-grade web-browser to the table for our offshore team members who bring their own device. This environment is 100% secure and constantly monitored, and we can also apply access controls and on-screen redacting of sensitive information if required.

- Quality of talent pool – we looked to locations such as the Philippines and Pakistan for our finance talent. Both countries have high degrees of university education at English-speaking universities, are highly proficient in English, have worked with many Anglo-Saxon companies previously via the flourishing BPO industries in both countries, and carry high levels of finance qualifications with CPA and CA. In fact, the 4-stage talent qualification that we designed to assess our own finance team members is the same one we now use for our clients today to help them build their own blended finance teams.

- Processes must be heavily documented and current – this one almost goes without saying, but by ensuring we assigned process and procedure ownership to onshore staff members, we not only found that it limited the learning curve to competency for offshore team members but also ensured consistency of output as well.

The results?

As I mentioned from the outset, the results of our blended finance team have been impressive. I’ll start with the ones that will get most CFOs and Finance Directors excited – cost and cash.

Cost: Each offshore hire costs around 80% less in salary and employment on-costs than an onshore hire. As a result, the total annual running cost of our Finance functions has reduced by about 50% with a blended approach.

Cash: Our blended team mix in the AR function allowed us to drive a surprising improvement in our overall DSO (Days Sales Outstanding), largely driven by the improvement in DSO through transactional collections. Our hypothesis here is focus – by the offshore team members focusing narrowly on the transactional book of clients, we saw significant improvements in this regard. This also allowed more senior staff to improve their DSO on higher-value accounts.

Equally pleasing, though, are the benefits we have experienced in the ‘softer’ aspects of our blended finance team, namely:

- Continuous improvement: With the support of offshore team members, our onshore staff have had renewed mental headspace and capacity to drive continuous improvement in processes within each of their finance functions. With this, we are now closing the books 2 business days earlier than we ever have before – this is two extra working days for everyone to focus on other activities, not to mention getting value-added insights into the hands of management sooner.

- Job satisfaction: Our onshore team members are experiencing higher job satisfaction through the support they now receive for more routine tasks, allowing them to focus on higher-value aspects of their own roles. Equally, we are providing excellent employment opportunities to offshore team members that they may not have otherwise been provided access to, so job satisfaction for offshore team members is super-high as well.

- Diversity of skill, thought, culture, and engagement: With a blended finance team, we have Australians, Filipinos, and Pakistanis coming together as a united team. We are working together, learning from each other, and learning about the aspects of professional and personal life that are prevalent in our respective cultures. This is driving higher levels of employee engagement across the board. Is it time you considered a blended finance team approach?

CFOs, FDs, and Finance Leaders, we would love to speak with you… get in touch here.